Murphy Thompson Moore LLP

Why choose us?

25yr innovative years of successful business leadership

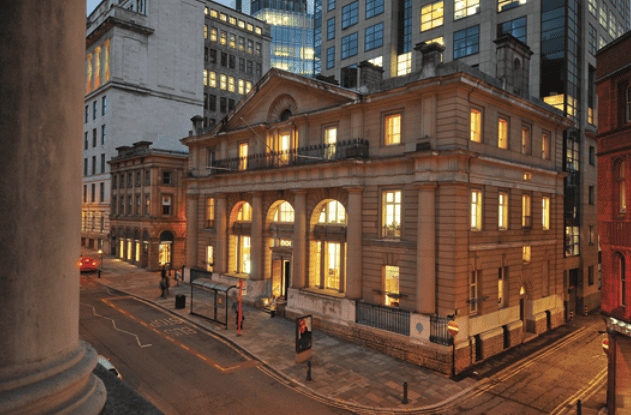

MTM are specialist, small business accountants, with an office on King Street in Manchester, known for their leadership in electronic filing, and who are trusted by many long-term clients as their key financial advisors.

Specialist advisors to Owner/Managed Businesses

MTM provide services exclusively to owner/managed businesses. Our typical clients employ from 5 to 25 people, are likely to be in the service sector.

At your side throughout the year. Not just year-end.

We meet with you regularly (usually via video call) to explain the work we have done, go through the reports and deal with any matters of current concern in the business. These calls can be 1 to 1 or with members of your team.

No billing suprises and an afordable, monthly fee.

Your engagement with us is based on a single fee to cover all your requirements throughout the year for both the business and your personal tax affairs. We operate a “no surprises” policy that you can rely on.

Contact us for information

about how we can tailor our services to your objectives.

enquiries@mtmllp.co.uk

*We (Murphy Thompson Moore Ltd) would like to contact you by post with relevant service updates and occassionally, exclusive offers for Clients. We won’t send these often and you can request that we don’t send updates or offers at any time. If you’d like to opt-out of these updates, please let us know within your message. We would also like to contact you by phone and email to respond to your message in order to provide the best service for you (which may include communicating particular offers available at the time). By giving us your details below, you agree you’re happy to receive these messages. We’ll look after your information. Your details will only be used as described in our privacy policy.